Compare Contractors Tool Insurance Rates

Learn more about the factors that dictate your contractors tool insurance rates, compare top insurers, and save.

Your information is secure.

Your information is secure. CONTRACTOR’S TOOLS AND EQUIPMENT

This type of coverage helps pay for repair or replacement of a contractor’s tools and equipment if they are lost, stolen or damaged, items TYPICALLY must be less than five years old.

What is contractor’s tools and equipment insurance?

This policy helps pay for repair or replacement of a contractor’s tools and equipment if they are lost, stolen, or damaged. The items typically must be less than five years old.

When do businesses need contractor’s tools and equipment insurance?

Contractor’s tools and equipment insurance is designed for construction and contracting companies that work at different job sites. It protects movable tools and equipment wherever they are stored and pays for repair or replacement if they are lost, damaged, or stolen. However, it does not cover general wear and tear.

This coverage is a form of inland marine insurance for small tools and equipment under $10,000. It can typically be added to your commercial property insurance policy.

This policy covers:

- Tool theft

- Equipment breakage

- Misplaced or lost items

- Vandalism

- Damage to leased or rented equipment

Contractor’s tools and equipment insurance protects against the unique risks of movable property

Construction companies and contractors depend on their tools to get the job done. However, a standard commercial property insurance policy might not cover tools in transit or equipment stored at a worksite. It’s risky to move items and store them off-site, which is why you may need additional coverage.

If your toolbox is stolen from a worksite or a recently purchased backhoe breaks during a project, contractor’s tools and equipment insurance can pay for its repair or replacement. The damage could happen while your belongings are in transit or in storage away from your business office.

Add contractor’s equipment coverage to your BOP

If you’re a small construction company or contractor, you may be able to add contractor’s tools and equipment coverage to your business owner’s policy. A BOP bundles general liability insurance with commercial property insurance, usually at a lower premium than purchasing each policy separately.

What does contractor’s tools and equipment insurance cover?

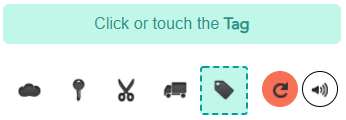

Stolen tools

Broken or damaged equipment

Vandalism

Leased or rented items