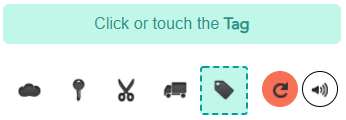

What types of insurance do doctors need?

Business owner’s policy

Business owner’s policy

A BOP bundles commercial property and general liability insurance under one plan. It's often one of the most cost-effective types of commercial insurance for physicians.

BEST FOR

-

Slip-and-fall accidents

-

Damaged patient property

-

Damaged business property

Professional liability insurance

This policy, also called malpractice insurance for physicians, covers legal expenses when patients sue over an error, such as an inaccurate assessment of their medical histor

BEST FOR

-

Failure to deliver promised services

-

Misdiagnosis or negligence

-

Mistakes or oversights

Workers’ compensation insurance

Workers’ compensation insurance is required in almost every state for medical practices that have employees. It can cover medical costs for work-related injuries.

BEST FOR

-

Employee medical expenses

-

Partial missed wages

-

Lawsuits over employee injuries

Cyber liability insurance

This policy helps doctors and physicians survive data breaches and cyberattacks. It can often be added to a business owner's policy or general liability policy for savings.

BEST FOR

-

Customer notification expenses

-

Data breach lawsuits

-

Fraud monitoring costs

How much does business insurance cost for doctors?

Several factors will have an impact on insurance costs, including:

Doctros Physician Services Offered

Medical equipment and property

Revenue

Location

Number of employees

Why do doctors need insurance?

Running a convenience store or a drug shop is a risky business. Since many stores are open 24 hours a day with minimal staff, they’re a prime target for criminals. Convenience store insurance and pharmacy insurance can help cover the cost of inventory theft, employee From diagnosis to treatment, physicians help their patients recover from injuries and ailments. They also face a lot of liability. Doctors’ insurance can help your small medical practice mitigate the risk and uncertainty of malpractice claims, medical equipment damage, staff accidents, and more.